1.0 Introduction

China’s bakery industry has a relatively short development history, and bakery products are mainly used as desserts and snacks in China. Hence, there is still a large consumption gap between China and other countries such as Europe and the United States.

Baked good is made of flour, yeast, salt, and sugar as the main ingredients, oil and dairy products as auxiliary materials, and prepared & baked using a similar method with some variations based on the type of final product. With the changes in the dietary structure of the Chinese, the per capita consumption of bakery products is on the rise, and baked goods such as cakes and bread have increasingly become an important part of consumers’ diets.

Hence, with the development and encouraging outlook of China’s baking industry, baking fats being one of the important raw materials in the baking industry, will its application & demand increases in tandem with this development.

2.0 Overview of China Bakery Market

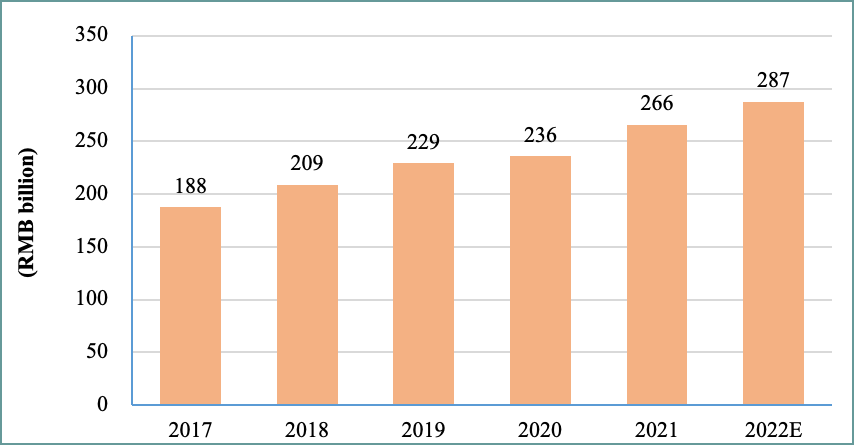

The scale of China’s baked goods market has maintained steady growth in recent years. From 2017 to 2021, the market size has increased from RMB187.7 billion to RMB265.7 billion, with an average annual compounded growth rate of about 9%, much higher than the growth rate of the global baking industry’s market size. It is expected that the market size of China’s baked food industry will reach RMB287.4 billion in 2022.

Chart 1: Market Size of China Bakery Food Industry in 2017-2022E

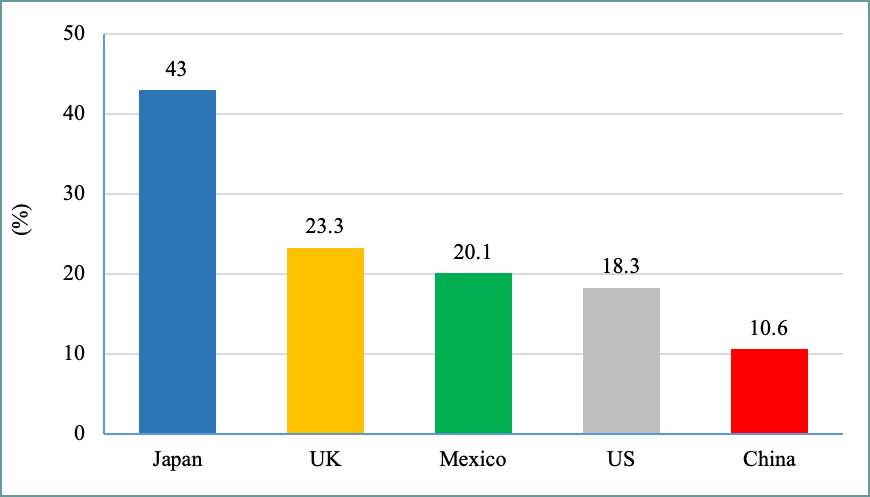

According to statistics from the Baking Professional Committee of the China Food Industry Association, in 2019, the per capita consumption of baked goods in China was about 7.8 kg. Although China’s consumption has increased steadily in recent years, it is still a large gap compared with other countries such as Europe and the US, and the industry also has a large room for growth.

Chart 2: Global Per Capita Consumption

2.2 Development of the Bakery Industry

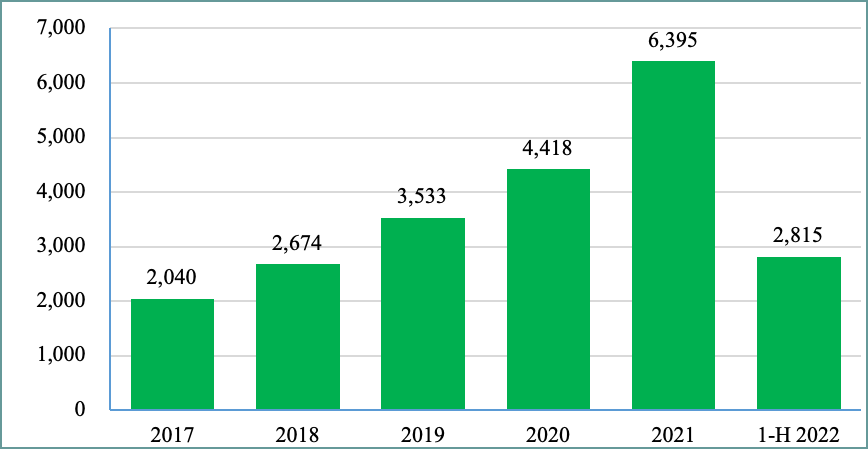

Another reason that shows a positive outlook for China’s bakery industry is that the registration of Chinese bakery-related companies has increased from 2,040 to 6,395 in 2017-2021, with an average annual compound growth rate of about 33%. In the first half year of 2022, the number of Chinese bakery-related companies registered reached 2,815.

Chart 3: China Registered Bakery Enterprises in 2017-1H2022

2.3 Investment in Bakery Industry

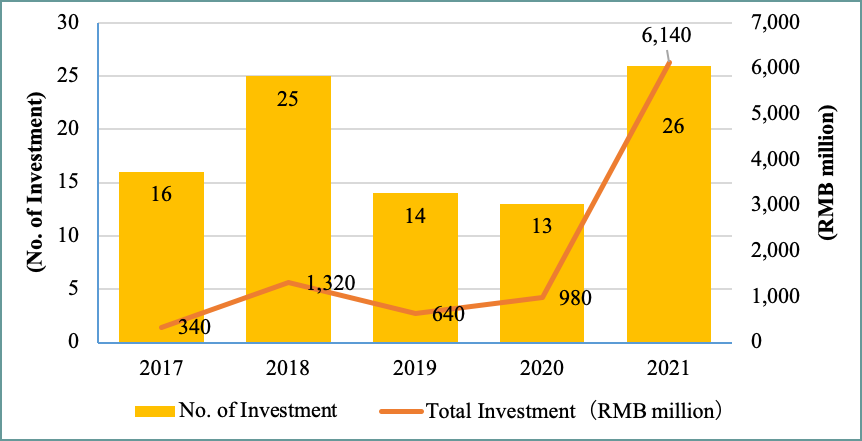

In 2021, the investment in the bakery industry was higher as compared to the previous year, with 26 investments and with a total amount of RMB6.14 billion. This could be attributed to the past- covid outbreak recovery in economic activities in the country, which gave more confidence to the investors and industry players to captive to the rising demand.

Chart 4: Investment of China’s bakery industry in 2017-2021

2.4 Industry Competition Pattern

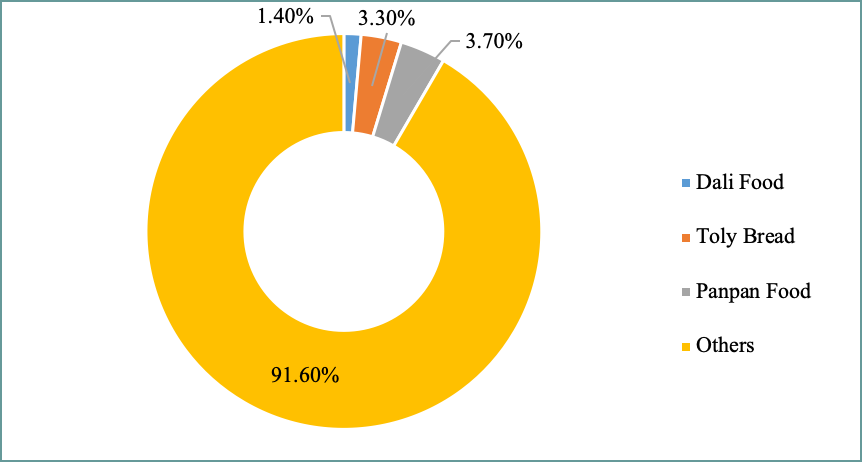

The market competition landscape of China’s bakery food industry is highly fragmented. According to relevant data, the top three companies in the industry are Dali Foods, Toly Bread, and Panpan Foods, with the total market share of only 8%.

Chart 5: Market Structure of China’s Bakery Industry in 2021

Compared with the global market, the Chinese baking industry has a low concentration. Compared with the 43% concentration of the top five companies in Japan, the top five companies in China’s baking industry only account for 10.6% of the total market.

Chart 7: Market Share of Top Five Companies in The World

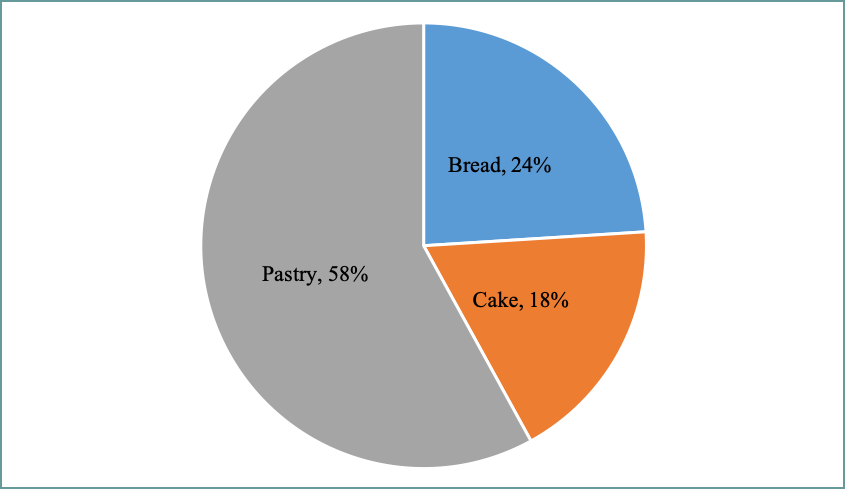

2.5 Bakery Products

Among the bakery products in China, bread consumption accounts for 24%, cake accounts for 18%, and pastry accounts for the largest proportion, at 58%.

Chart 8: Composition of Bakery Products in China

3.0 Key Enterprises of the Bakery Industry

3.1 Toly Bread

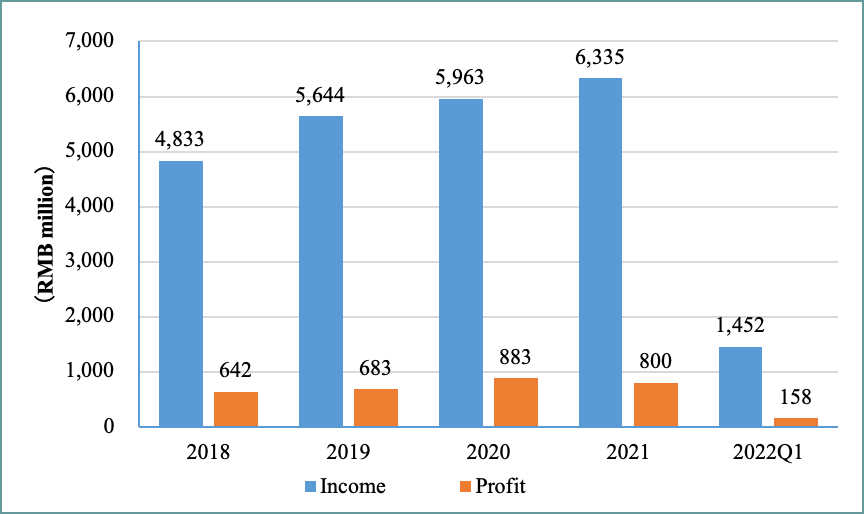

Toly Bread Co., Ltd. was formerly known as Shenyang Toly Food Co., Ltd, which was established in January 1997, which mainly engaged in bread, cakes, and moon cakes. It is a comprehensive company dedicated to the production, processing, and sales of baked goods. After years of hard work and accumulation, Toly has grown into a cross-regional renowned bakery brand.

In 2021, Toly Bread achieved an operating income of RMB6.335 billion, a y-o-y increase of 6.24%; net profit of RMB800 million, a y-o-y decrease of 13.54%, which was also the first drop in Toly Bread’s net profit in the past 10 years. In the first quarter of 2022, the revenue was RMB1.452 billion, and the net profit was RMB158 million.

Chart 9: Revenue & Profit of Toly (2018-2022Q1)

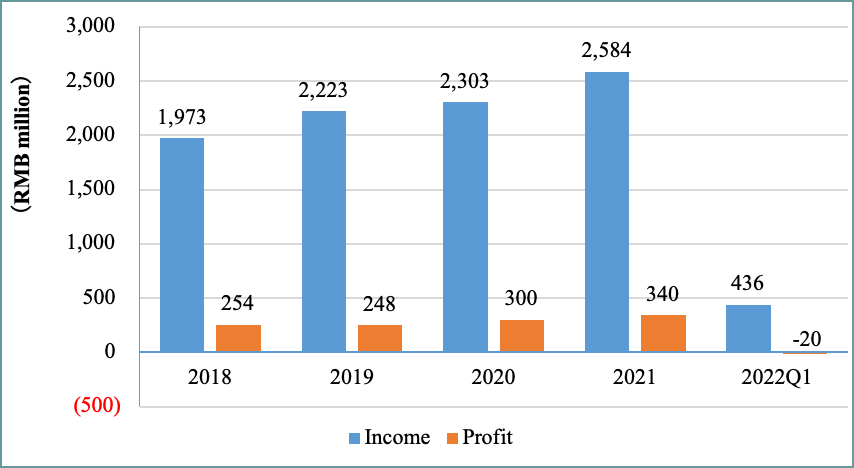

3.2 GANSO Co., Ltd.

Shanghai GANSO Co., Ltd. is mainly engaged in the research and development, production and sales of baked food. It is a national chain operation enterprise specializing in the production of cakes, moon cakes, Chinese and Western cakes and other bakery products. Founded in 2002, its products have gradually improved the popularity and the company has become one of the leading brands in China bakery market.

In 2021, GANSO Co., Ltd. achieved a total operating income of RMB2.584 billion, a y-o-y increase of 12.20%; net profit attributable to the parent company of RMB340 million, a y-o-y increase of 13.27%. In the first quarter of 2022, the revenue was at RMB436 million, and the net profit was a loss of RMB20 million.

Chart 10: Revenue & Profit of GANSO (2018-2022Q1)

3.3 Ligao Food Co., Ltd.

Ligao Foods Co., Ltd. is a large-scale joint-stock listed enterprise integrating R&D, production, and sales of baked food raw materials and frozen baked food. Headquartered in Guangzhou, the company has 8 wholly-owned subsidiaries and 2 branches. Ligao Foods, Aokun Foods, and Haodao Foods (Meihuang), which are subsidiaries of Ligao, cover the fields of baked food raw materials, frozen baked foods and baking sauces.

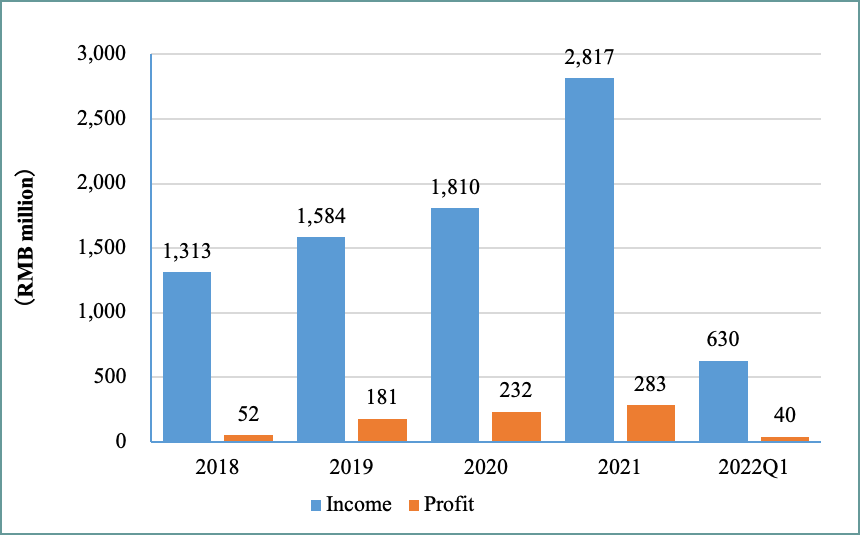

In 2021, Ligao Foods’ revenue was at RMB2.817 billion, a y-o-y increase of 55.7%; and net profit was at RMB283 million, a y-o-y increase of 22.0%. In the first quarter of 2022, the revenue reached RMB630 million, and the net profit was RMB40 million.

Chart 11: Revenue & Profit of Ligao (2018-2022Q1)

3.4 Dali Food

Dali Foods Group was established in Quanzhou in 1989 and was listed on the main board of the Hong Kong Stock Exchange in 2015. It has grown into a comprehensive modern food enterprise ranked among the top 500 private enterprises in China. Dali Foods Group focuses on the food industry, forming an industrial structure in which the two pillars of food and beverages. Its “Daliyuan” pastries, “Haochidian” biscuits, “Copic” potato chips, “Heqizheng” herbal tea, “Daliyuan” peanut milk, “Lehu” functional drink, “Doubendou” soy milk, “Meibeichen” short-term bread has become a well-known brand in various industries.

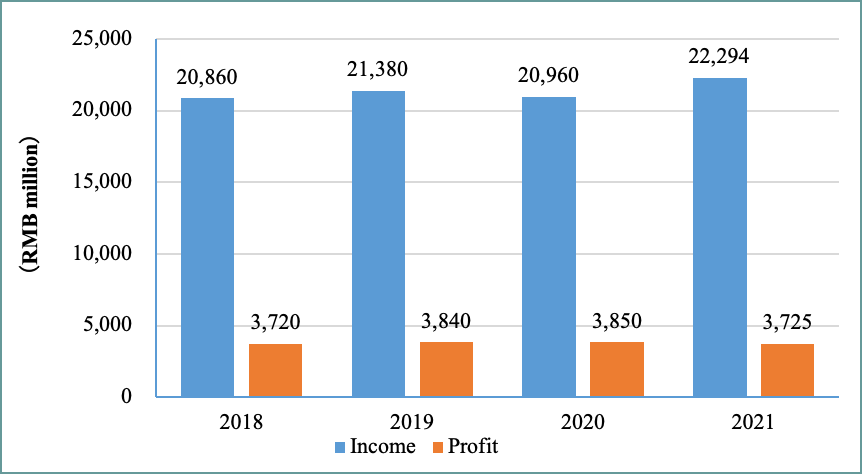

In 2021, Dali Foods achieved an operating income of RMB22.294 billion, a y-o-y increase of 6.4%; and the net profit of RMB3.725 billion, with the y-o-y decrease of 3.2%.

Chart 12: Revenue & Profit of Dali (2018-2022Q1)

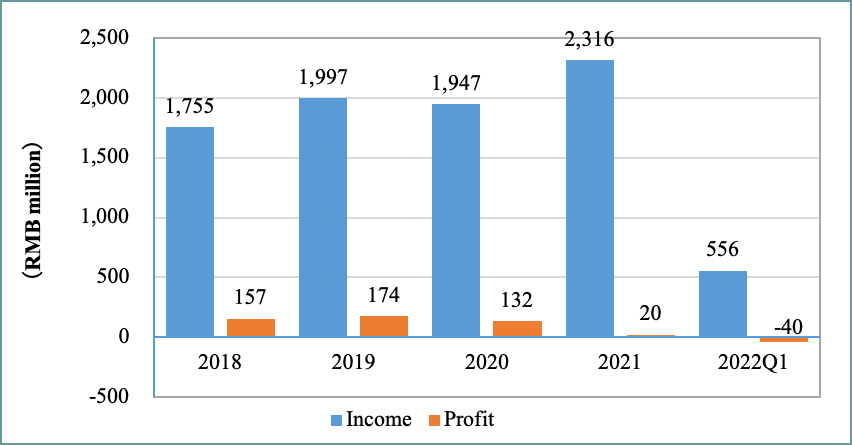

3.5 INM Food

INM Food Company is principally engaged in the research & development, production, sales, and chain operation of fresh dairy products and bakery products. In 2021, INM Foods achieved an operating income of RMB2.316 billion, a y-o-ye increase of 18.96%; net profit was RMB20.2578 million, a y-o-y decrease of 84.70%. In the first quarter of 2022, the revenue was at RMB556 million, and the net profit was at a loss of RMB40 million.

Chart 13: Revenue & Profit of INM (2018-2022Q1)

4.0 Outlook for China’s Bakery Industry

4.1 Low Per Capita Consumption and Huge Market Space

Although China’s bakery food industry has grown rapidly in recent years, the per capita consumption level is far lower than that of developed countries, and there is huge room for improvement in the future. Since baked goods entered China relatively late, consumers are still in the process of accepting them. With changes in eating habits, China’s per capita consumption will increase in the future. In addition, there are currently a large number of small and medium-sized enterprises in the bakery food industry and individual-run bakery shop. In addition, there are a large number of small and medium-sized enterprises in the bakery food industry, the quality of bakery food is uneven, and the product price is relatively low. In the future, with the upgrading of consumption, consumers’ requirements for product quality and consumption experience will increase, and the increase in unit price will also drive the increase in the scale of the baking industry.

4.2 Younger Generation’s Westernization Eating Habits Promotes the Development of the Bakery Industry

Generally, residents’ dietary consumption patterns are divided into three categories: staple food consumption, leisure consumption and festival consumption. Among them, staple food consumption is the most important form. With the improvement of residents’ living standards, the proportion of leisure consumption, and festival consumption is increasing rapidly. At present, the younger generation continues to pursue a rich, convenient and fast lifestyle, and their dining habits are gradually westernized, which in turn promotes the development of the baking industry.

4.3 Safety, Nutrition, Health, and Freshly Baked Products Become the Development Trend

With the upgrading of consumption, the concept of a healthy diet has been deeply rooted in the hearts of the people. According to the Nielsen health and food composition opinion survey, about 70% of the respondents have specific dietary needs, and they will control or refuse to eat certain foods or ingredients, and 82% of the respondents are willing to spend more money on healthier food. With consumers paying more attention to safety, nutrition, and health, baked products are also changing.

4.4 Types and Sales Channels of Baked Food are Constantly Diversified

As Chinese consumers’ acceptance of baked goods continues to rise, people’s demand for types of baked goods is becoming more diversified. With the higher purchasing power, there is an increasing trend among consumers preferring freshly baked products, and this kind of bakery products with its aroma not only create a good atmosphere for the store, but most importantly stimulate purchase. Because of this, the sales of baked goods is not just found in bakery shops but also many supermarkets. The available of baked foods in these non-traditional retail outlets has also changing the Chinese habit in making the baked good becoming staple food, and likewise, more restaurants, hotels, etc. also began to provide bakery products to capture the business opportunities offered by this consumption trend.

4.5 Steady Rise in Market Concentration

In addition to large chain bakery brands, there are a large number of small and medium-sized baking enterprises in the Chinese bakery market. These small enterprises have fewer product categories, unstable quality, and low production efficiency. In recent years, driven by strict food safety management and consumption upgrades, the concentration of the baking industry has gradually increased.

5.0 Bakery Fats

Bakery fat is one of the most important raw materials for baking food. It can provide dough with appropriate ductility and plasticization, and give baking products a soft, crisp and stable shape. As the upstream and downstream relationship in the industrial chain, the development of the bakery fat industry and baked food industry are closely related.

The bakery fats in the Chinese market mainly include margarine, shortening, and butter. Bakery fats can be widely used in the food industry, including cakes, cookies, candy, frozen drinks, and even some pharmaceutical or chemical uses.

5.1 Shortening

As a raw material for food processing, shortening has many excellent processing properties such as plasticity, caseation, shortening, emulsification, water absorption, etc. It has a large application demand in the field of snack food production, mainly used for processing cakes, bread, or fried food.

In recent years, with the development of the bakery industry, shortening is the main raw material for the production of various baked goods, and its market consumption demand is also expanding annually. However, the annual production of shortening in China is far from meeting the growing domestic consumption demand, which leads to a high degree of dependence on imported shortening products in the domestic market. According to relevant data released by the General Administration of Customs of China, the import volume of shortening has increased year by year, among which Indonesia and Malaysia are the main source countries of the country’s imported shortening.

The import volume of shortening in China has increased year by year, and the main importing country is Indonesia. In 2021, China imported 7,655 MT of shortening from Malaysia. Aside from steady growth in the demand of bakery products, the use of shortening (or known as frying shortening) has also increased drastically in 2021, partly also due to the change in export duty structure in Indonesia, which explains why the sudden surge in import.

Chart 14: China – Import of Shortening by Country

5.2 Butter

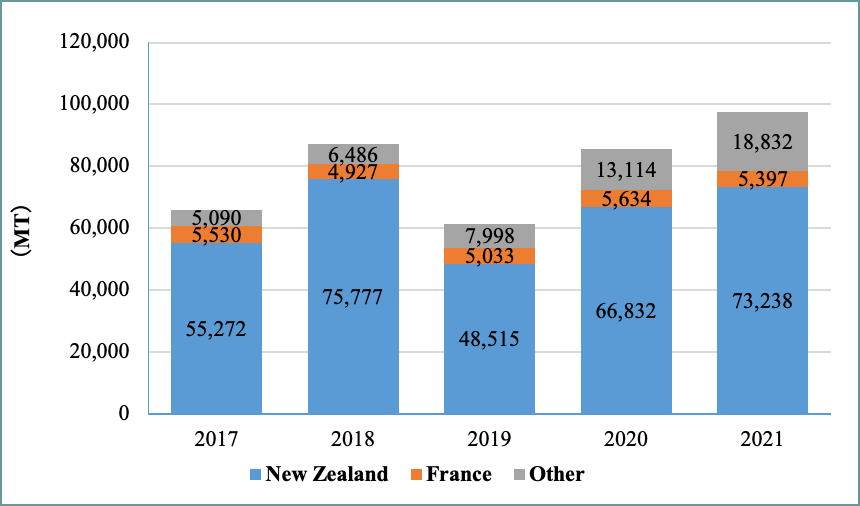

The output of China’s butter industry is relatively small, and about half of it depends on imports. With the fusion of Chinese and Western food cultures, Chinese consumption of Western-style catering and baked goods continues to rise, driving the growing demand for butter. China’s national butter imports showed a high-speed upward trend in recent years.

China’s butter production is small, and most of the increased consumer demand comes from imports, of which New Zealand’s imported butter accounts for the largest proportion. From 2017 to 2021, China’s imported butter imports showed an increasing trend. Although the impact of the epidemic slowed down the import slightly in 2019, the total import of butter in China rebounded rapidly in 2020, with a y-o-y increase of 39.1% from 2019.

Chart 15: China – Import of Butter by Country

5.3 Margarine

Margarine is mainly used for surface decoration and filling of cakes and pastries, as well as baking processing of western cooking or baked goods such as bread, cake embryos, and Chinese desserts.

In China, vegetable oils such as soybean oil, rapeseed oil, palm oil, and their fractions have become the main raw materials for the production of margarine in my country. At present, China’s margarine industry is still in the initial stage and growth stage. China’s margarine market is growing rapidly, with an annual growth rate of 20%, and the continued growth of the bakery market will also drive the growth of the upstream market. China mainly imports margarine from Indonesia, and China imported 650 MT from Malaysia in 2021, an increase of 10% from 590 MT in 2020.

Chart 16: China – Import of Margarine by Country

6.0 Conclusion

At present, China’s bakery industry is still in the development stage, and with per capita consumption much lower than that of other countries, and the room for further expansion in the bakery industry remain huge. Hence, the industry players expected that China’s bakery market will still maintain rapid development in the next few years, and as one of the essential baking ingredients, the demand for bakery fat will also gradually increase.

Since shortening and margarine are mainly processed from palm oil, both Indonesia and Malaysia are China’s main suppliers with Indonesia leading the market share. Nevertheless, the rapid expansion foresee in the bakery market in China will enlarge the “cake” of this market, which offer opportunities for more import of Malaysia palm products in the future. The gradual opening of China’s border to business travelers when the covid-19 pandemic is under control will serve as a good opportunity for Malaysian bakery fats players to take advantage to build business more contacts to capture this growing opportunity.

Prepared by Desmond Ng and Xiao Wen Yan

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.